Impact of Digital Transformation in Retail Banking Industry

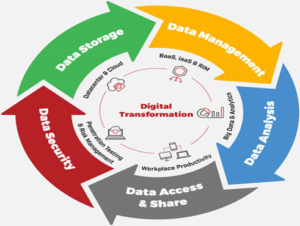

Digital transformation means re-defining business processes in this new digital era. The four main areas of digital transformation are process, technology, data, and organizational change.

What is Digital Transformation?

When it comes to Digitization, the very first question that arises in everyone’s mind is that what Digital Transformation is?

Digital Transformation states the adoption of digital technologies by MNCs which in result increases efficiency, improves innovation and add new values to the company.

What is the impact of Digital Transformation in Banking Sector?

In the banking industry, nowadays, technologies are tearing down barriers to entry and opening doors for new financial service providers. Most of the bank leaders understand that digital transformation is essential for long-term growth, sustainability, and success.

In a recent survey of global banking executives it was found that almost 60 percent of respondents stating that the boundaries between industries are blurring by the IBM Institute of Business Value (IBV) and on the other side more that 60 percent of respondents saw the competition from new and unexpected places.

Bank needs to understand the importance of Digital Transformation and Digital Reinvention for them. When we talk about IBM, IBM Reinvention is a framework that abbreviates the drastic changes required, which would involve fundamental re-conception of operations, strategy and technologies from the ground level.

What is the impact of Digital Banking and E-commerce on Indian Rural Areas?

Digital Transformation has become a buzz word in today’s era. Information Technology today has a crucial role to play in an efficient banking system, and Indian banks have placed a strong infrastructure to leverage its benefits by moving on to contextual banking and open Application Programming Interface.

When mentioning about E-commerce, since the last few decades the business of the world is getting ruled by E-commerce. Thousands of businesses have moved online to utilize the potential of the Internet for reaching a wider audience. Nowadays, E-commerce has become the world wide necessity for the business growth.

Digital Commerce has made the living in rural areas easy by upgrading the facilities and including the digital services. Digital Commerce is the win-win situation for both the merchants and consumers as merchants are able to sell the high quality goods by earning more profit in less time whereas on the other side consumers are fascinated by high brands, comforts and fashions.

Adoption of e-commerce in rural areas also brought some hindrances and challenges like:

- Customers might get apprehensive because of the lack of on-ground presence in their area.

- Language becoming the key barrier as a majority of e-commerce websites use English as the language.

- Portfolio of the product is also crucial for the success of a seller.

- Non availability of laptops, desktops, mobile phones as the product seller influencing on networking sites to advertise their brands.

However, despite these barriers, e-commerce sellers and brands has touched the rural parts effectively by changing the thought that e-commerce companies cannot evolve in rural region of India.

The e-commerce giants like Myntra, Jabong, Voonik, Amazon, Shopclues, Flip Kart and others are getting appreciable revenue coverage from the villages as even the villagers are getting benefits of online delivery system. The penetration of the Internet and the smartphones helps most of the villagers how to use mobile applications and computers to order their goods which makes their living both easy and upgraded.

GeM, Government e-Marketplace is a one stop portal to facilitate online procurement of common use goods & services required by various departments, organizations, PSUs of Government.

GeM helps in the rural upliftment by improving the quality of life and economic well-being of people living in rural areas by providing them the necessary goods through online services.

GeM aims to enhance transparency, efficiency and speed in public procurement. It provides a way in helping Government in achieving the best value for their money.

How Insight International helping Clients to adapt Digital Banking?

Insight International plays a major role in the world of digital transformation. Clients need to adopt this new digital banking for which Insight International creating awareness about the benefits and importance of digital transformation among the clients.

Further Insight International states that Digital Transformation in Banking Industry includes continuous improvement in the company. With the help of digital transformation skillset is getting improved which further helps in identifying viable solutions for all the problems occurring.

Digital Transformation helps in modernizing infrastructure and leveraging power of data which makes it completely digital-driven.

Digital Banking acts as a key for enabling digital services in the banking sector. From cloud computing to digital security to new communication technologies, all form the backbone of disruptive business models in the banking sector.

Digital Banking provides a methodology about Digital Reinvention that starts by identifying the value propositions that banks can leverage to differentiate themselves as digital brands.

Digital Banking is now involved in almost all the technologies such as on mobile applications people are performing 24 x 7 banking, online transactions which is possible with the help of Digital Transformation.

There are many ways to be a digital bank and each bank must find its own path. Digital Banking can be implemented with the following five main stages:

- Digital strategy is based on a bank’s specific vision and mission, the competitive context and target business model with methods such as Digital Reinvention.

- Digital capabilities assessment is driven by the digital strategy. Identify the business and IT capabilities that the bank should develop and deploy to support a new digital business model.

- Target operating model alignment is based on the DBF operating impact model. This step defines changes required to support the desired digital maturity.

- IT architecture alignment is a crucial element in the transformation of the operating model transformation, and the evolution of the bank’s business and IT architecture.

- Digital Reinvention roadmap. Once the digital strategy, operating model and target architecture are defined, and the bank’s budget plan, resources and risk appetite are considered, all changes are orchestrated into a transformation program.

What are the Benefits of Digital Transformation in Banking Sector?

Digital Transformations in Retail Banking industry has evolved several benefits that helps company to increase its growth and value.

Five main Key Banking Technology trends that adds value to the banking industry are:

- Digitization in banking sector will enhance digital services with external APIs.

- Mobile banking will become more frictionless and increases efficiency and security of online transactions.

- Digital Banking in Artificial Intelligence will improve the relationship between the customer and the client.

- Digital Banking will increase the security by including Biometrics.

- Digital Banking in IoT will be deployed on small scale businesses and industries.

Therefore, the imperative for Digital Reinvention in banking is tangible. Taking a structured DBF approach can help minimize disruption and improve the odds of success.